“What’s my conversion rate going to be?” is probably the most common question we get from clients. We define conversion rate as the percentage of visitors seeing a paid offer who convert. It’s much more common to succeed with subscriptions through high exposure and low conversion rates than the reverse. The average paid conversion rate is ~0.2 percent, but there is a range; our clients see conversion rates from over 10 percent to a couple hundredths of a percent. Here’s why.

Message placement matters

Conversion depends quite a lot on the mix of subscription messages and how often each type is shown to users. There are four basic ways users see subscription offers:

- A subscription landing page, to which the user chooses to navigate

- A “hard” paywall that prevents users from reading or viewing more without taking action

- A “soft” paywall that interrupts their reading, but can be dismissed without paying

- A ribbon or other gentle notification that covers only part of the page, doesn’t interfere with reading and

can be easily ignored

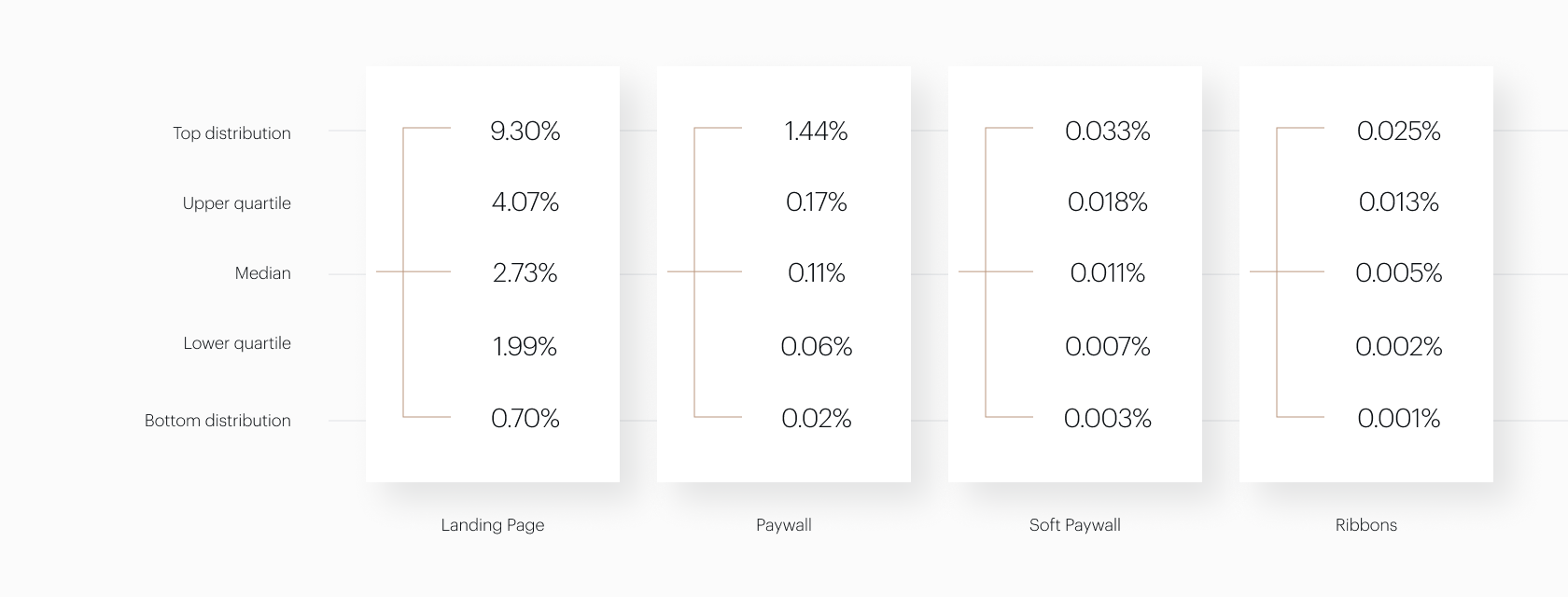

Those different paid templates, as we call them in the Piano platform, play different roles in the conversion journey, and so have very different exposure and conversion rates:

- Ribbons, or soft paywalls, are most often used early in the funnel, counting down remaining article views for a metered paywall or promoting subscriptions and brand value proposition generally. Taken together, they add up to nearly 60 percent of subscription message exposures on average, but less than 10 percent of conversions.

- Hard paywalls are most effective in driving action, because they force the reader to decide on the spot — either pay or stop reading. While hard paywalls have a lower share of conversions than landing pages, they play a crucial role in establishing the value exchange.

- Landing pages have relatively few visitors, but those who go there have a high intent to pay, so in this case, the lowest share of exposures delivers the highest share of conversions.

Those different formats and exposure tactics produce very different conversion rates. And of course, there’s a range of performance within each of those types, driven by price, messaging, product, exposure rates, page layout and more.

Focusing on the median, you can see in the chart above that landing pages have 25 times higher conversion rates than hard paywalls. Landing page conversions, however, are often a consequence of other tactics. They may be visitors who were previously stopped by the paywall, visitors who are searching out your subscription offering from paid campaigns or word of mouth or are otherwise highly primed to buy.

Clearly, you should invest a lot of time in optimising your landing pages. But the hard paywall, even at a fraction of the conversion rate, is often the lever that has the most impact on conversions overall, since you control the number of visitors intercepted by it. Hard paywalls have 10 times higher conversion rates than soft paywalls, which have double the conversion rate of bottom ribbons, as seen below.

The bottom line is that you can’t think of these offers as entirely independent. For example, an effective bottom ribbon may prime a visitor to convert at a higher rate (or retain better) when they hit the paywall. But the numbers do show the most important types of subscriber messaging to optimise.

Free trials faded

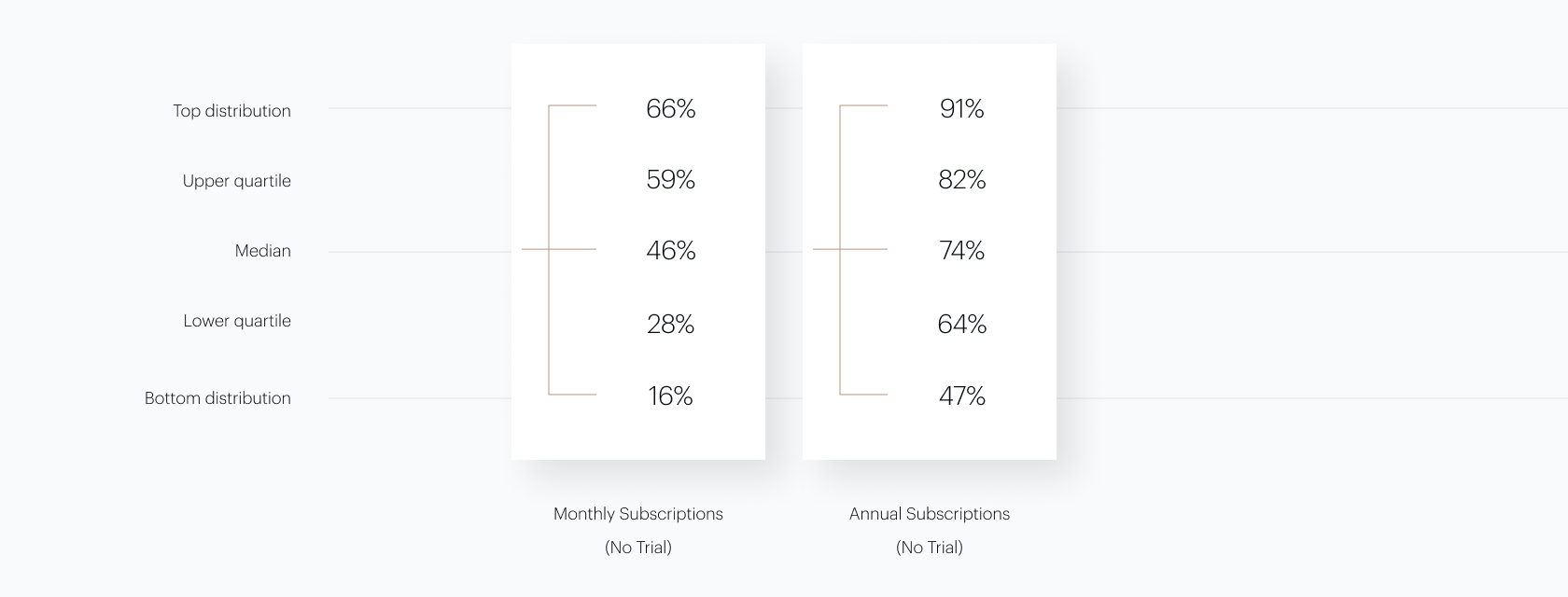

Seventeen percent of new monthly subscriptions in January of 2020 included a free trial. By December of 2020, fewer than 5 percent of monthly subscriptions included one. This indicates that publishers are getting more confident in their pricing and smarter about promotional strategies, since free trials often don't make financial sense when carefully analysed.

Trials generally have a big impact on retention. Non-trial monthly subscriptions have a median retention rate of 86.1 percent from the first month to the second. Paid trials, even at a relatively low price like $1, retain 82.1 percent when the trial period is over. But free trials retain only 61.7 percent when users have to start paying — with significantly lower lifetime value as a result.

Trial periods are important drivers of acquisition — there are instances where the conversion rate doubles due to a trial offer. But free trials often don’t increase conversion rate significantly above paid trials, making a paid trial the better choice in most instances due to higher retention.

Given the decline in free trials over the course of 2020, this appears to be increasingly widely understood amongst executives running subscription businesses.

Let's talk

Let's talk